Angela Cheong, CMO from fintech location-based moneychanger 4xLabs and its recent launch of Get4x

Social Media Portal (SMP): What is your name and what do you do there for 4xLabs?

Social Media Portal (SMP): What is your name and what do you do there for 4xLabs?

Angela Cheong (AC): My name is

Angela Cheong and I am the CMO of 4xLabs. I oversee all marketing programs for both our B2C product called Get4x and our B2B product called Biz4x.

SMP: Briefly, tell us about 4xLabs what is it and what does company do?AC: 4xLabs is a forward thinking technology company that is bringing efficiency and transparency to the foreign exchange market. We build web tools and mobile apps for travellers and provide APIs and software platforms for money changers. Our flagship products are Get4x and Biz4x.

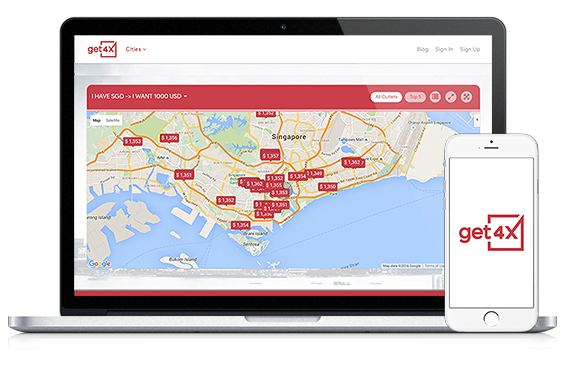

Get4x is a location-based app that helps users locate the best cash exchange rates from moneychangers nearby in cities across the world.

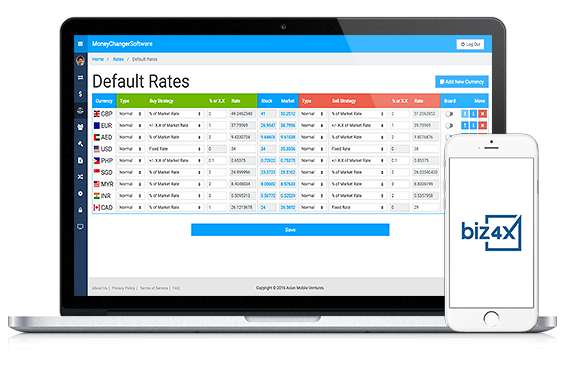

Biz4x is an integrated suite of tools that helps money changers better manage their operations by providing them with live FX rates, compliance services, management software and access to new customers.

SMP: Who are your target audience and why?AC:

SMP: Who are your target audience and why?AC: For Get4x, our target audience is savvy travellers, whether leisure or business, who are looking to save on exchange rates. For Biz4x, our target audience is the money changer who is looking for an end-to-end SaaS platform that can help manage business operations.

SMP: When was 4xLabs founded, how many people work there have how is it funded?AC: When 4xLabs was founded (2011) by Julien Labruyere working on the product. The team has since expanded to 30 people with offices in Singapore, Vietnam, Malaysia and Hong Kong. We are backed by a fintech focused VC fund, Dymon Asia Ventures.

SMP: You recently released Get4x, how is that going?AC: Previously Get4x was only available in Singapore, but we?ve expanded aggressively in the last few months, opening up in seven new travel destinations: Bali, Bangkok, Kuala Lumpur, Hong Kong, Mumbai, Pattaya and Phuket, and are seeing new user growth in these regions.

SMP: When was Get4x created, who are you audience and why did you decide to release it?AC: Our CEO and founder, Julien Labruyere came up with the idea for Get4x to solve a real problem that he experienced as a frequent business traveller. In December 2011, he was looking to exchange 5,000 euros in Singapore and was speaking with a friend about the difficulty in comparing different money changer rates, when he realized that this was a common frustration faced by travellers.

The lack of price transparency in this cash exchange market led to them getting a bad deal when exchanging currency with local money changers. Thinking that there had to be a better solution, Julien began to search for an app or platform that would allow him to compare money changer rates in real time the same way that people compare prices of air tickets through Skyscanner or accommodation deals through Agoda.

He was surprised that there was no such app available, and began talking to his local and foreign friends about the business concept of Get4x. Their feedback was overwhelmingly positive as it solved a widespread frustration, and thus Get4x was officially launched in 2012.

SMP: Why is Get4x different and how are your audience taking to it?AC: Get4x solves a problem that exists due to a market gap. Although travellers can search for interbank rates online, these exchange rates do not really apply to them. Usually they would have to go to a money changer to exchange cash and will discover that the rates are quite different. Our app takes into account both live and historical cash exchange rates that have been set by different money changers. With the huge amount of data we have curated, we are able to display live and predictive rates for money changers in different cities so travellers have all the information they need to choose the best outlet to exchange their cash. They can then log in through our app and contact the money changers directly to secure and confirm a good rate. Without the price transparency provided by Get4x, they would have to travel from outlet to outlet to manually note down the rates, which can be taxing and time-consuming.

To date, Get4x has 50,000 downloads, mostly in Singapore, and we are looking to grow this database exponentially with the launch of our app in numerous new territories.

SMP: When did you launch Biz4x and why this different to what is already out in the market?AC:

SMP: When did you launch Biz4x and why this different to what is already out in the market?AC: Many money changer operations are traditional family-run small and medium-sized enterprises that are on legacy software. Biz4x is our solution for all money changer needs and more, and it is helping to transform traditional brick and mortar businesses with technology, so they can remain relevant in this mobile-first age. It provides money changers with live FX rates, compliance services, inventory management software and online booking currency orders from customers through a SaaS platform, which offers all the capabilities money changers need to grow their business. We?ve seen massive growth in the 6 months since we?ve launched and have captured 30% of the money changer market.

SMP: What are the challenges that you?ve encountered and how are you overcoming them in what you have been doing so far at 4xLabs?AC: Trying to grow awareness of both Get4x and Biz4x has been an on-going challenge, especially since we?ve launched in new regions. We have good market awareness in Singapore having been in this space for a couple of years, with limited marketing spend, but the challenge is really to replicate what we have successfully done in Singapore several times over in these new territories we are now in. Every time we open a new market, we have to think about the target audience in these regions, and what would appeal to them in terms of messaging. We do a lot of localization and press outreach each time we launch in new markets and that has worked really well for us so far.

SMP: What are the high moments of what you have been doing so far?AC:

SMP: What are the high moments of what you have been doing so far?AC: Seeing something that we have worked on go live on the app is always a high point for us. I spend a lot of my time on PR as well, so being able to monitor how significant press coverage for us increases our downloads is always a sign of time spent both well and productively, which makes me happy. For example, we were covered in a major tech publication this year, which more than tripled our usual downloads and that sense of accomplishment that you get from successfully working in collaboration with your team towards achieving this outcome is hard to beat.

SMP: What do you see as your biggest challenges and opportunities for your sector and the competition that you have?AC: We have two biggest challenges really. The first is to gain awareness from the public that the service we provide exists. Many people exchanging cash with money changers experience a lot of frustration, especially when they are transacting in large amounts, because there is no transparency in this business. Without comparing exchange rates across a number of money changers, you never know whether or not you are getting a good deal. The opportunity here is when we are able to reach out to these people through PR or word-of-mouth and you really see their faces light up, because they can immediately see how the Get4x app can benefit them.

The second challenge we face is that the money changer business in Asia is generally very traditional and tends to be family owned, hence there is a great deal of suspicion about working with an external party or even new technology. The issue we are facing is one of transformation, specifically how do we transform a legacy business into one that is modern and relevant to today's mobile-first generation? What we've found is that a new generation of money changers is beginning to take over their family businesses, and this group of money changers is more outward-looking and are eager to tap upon new technologies and engage with the customer on their terms. We launched our B2B product for money changers called Biz4x in response to this opportunity we saw in the market to help these businesses manage their operations and ensure compliance with local regulations.

SMP: What do you think is going to be the most interesting aspect regarding fintech for the next 12 to 18-months and why?AC: The market outlook is a bit gloomy at the moment, but what is interesting is the prediction that fintech will continue to do well and attract investment. A

Reuters article noted that there was a $4.5 billion investment in Asian financial start-ups last year, which was quadruple that of the year before.

Accenture reported that global investment in financial start-ups was $5.3 billion in the first quarter of this year, up by 67% over the same period last year. We are going to see this trend continue throughout the year amid the global funding slowdown for start-ups in general.

SMP: What are your top five predictions for fintech for the next 12 to 18-months and why?

AC replies with:

- As mentioned earlier, I think we?ll continue to see a significant amount of investment in fintech companies in Asia, especially if these fintechs provide services that are complementary to the major financial institutions. At the same time, we may see more acquisitions by banks when it comes to fintechs that are disrupting their services.

- This is the year for blockchain. There will be more investment, partnerships and buzz around blockchain as financial institutions scramble to develop and better leverage this bitcoin technology.

- Start-ups will continue to launch many mobile wallet products, but unless the issue of market fragmentation is solved, no one company will emerge as the dominant leader in this field.

- There will be a delicate balance between regulation and emerging technologies. Increasingly, sandboxes are going to come into play so fintechs can forge ahead with their new technologies without coming into conflict with regulators.

- Fintechs that are bringing about greater transparency in the sectors they operate in will see success. This has already happened with blockchain technology, P2P lending start-ups and 4xLabs to some extent!

AC: What are your top overall five fintech/ start -up tips and why?AC replies with:

- It?s important to know who your regulators are in the sectors you operate in, and be familiar with the regulation and rules governing the areas in which you operate as that can make or break your business.

- Hiring the right people is key. Start-ups are fast-paced, flexible and things change quickly. You need talent with those traits as well, who are capable of being adaptable and wearing many hats. Remember that each person you bring into the company will shape the culture as well so hire wisely.

- I think many companies fail when they try to do many things at one go. It?s important to focus on your unique selling proposition. As they say in marketing and branding, if you stand for everything, you will end up standing for nothing. This is true for start-ups as well.

- Time is perhaps the greatest resource for all start-ups. Knowing what not to do is as important as knowing what to do. The opportunity cost and stakes are far higher when you have limited resources.

Get4x is expanding rapidly to all major travel hubs, so keep a look out for us as we continue to launch the Get4x service in more new cities before the end of the year.

SMP: Best way to contact you and 4xLabs (please include any hashtags and relevant social accounts)?AC: We can be reached at

hello@4xlabs.co. You can always say hello to me via

LinkedIn as well.

We also have the following social media accounts.

Get4xTwitter

@get4xFacebookGoogle+LinkedInWebsite4xLabsLinkedInDownload Get4x on

Android and

iOS.

Now some questions for fun

SMP: What did you have for breakfast / lunch?AC: Toast and coffee. Coffee is my fuel. I need it so I can kick-start the day and be at my most productive.

SMP: What?s the last good thing that you did for someone?AC: I volunteer with a social enterprise that helps underprivileged women by providing them with employment opportunities through skills training and other programmes called

Daughters of Tomorrow. They?ve recently launched a new IT literacy programme for the women and I?m helping to manage training for a new batch of trainees.

SMP: If you weren?t working at 4xLabs what would you be doing?AC: I would still be doing marketing, just at another tech company!

SMP: When / where did you go on your last business trip or holiday and why?AC: The last place I went to for business was Hong Kong to attend RISE conference. I met a lot of interesting people there who were all keen on learning more about the Get4x app as they were all business travellers who could see that immediate benefit to them in terms of cost savings.

SMP What?s the first thing you do when you get into the office of a morning?AC: I check my email and make sure that there is nothing urgent that has come in that requires my immediate attention. After that, I begin working down my to-do list for the day.

SMP: If you had a superpower what would it be and why?AC: Teleportation. That will mean I can work in San Francisco, have lunch in Shanghai, go for meetings in London, and still be able to live in Singapore, where I?m from! Pretty much the best of all worlds, don?t you think?

Got an interesting story? Get in touch.